The India-EU Free Trade Agreement announced on January 27, 2026, opens unprecedented opportunities for Indian exporters and businesses. Over 99% of Indian exports will now receive preferential tariff access to European Union markets, covering 450 million consumers across 27 countries.

This comprehensive trade deal provides immediate benefits for labour-intensive sectors including textiles, leather, marine products, gems and jewellery, and handicrafts—totaling $33 billion in exports. Agricultural exporters of tea, coffee, spices, and processed foods will also gain enhanced market access.

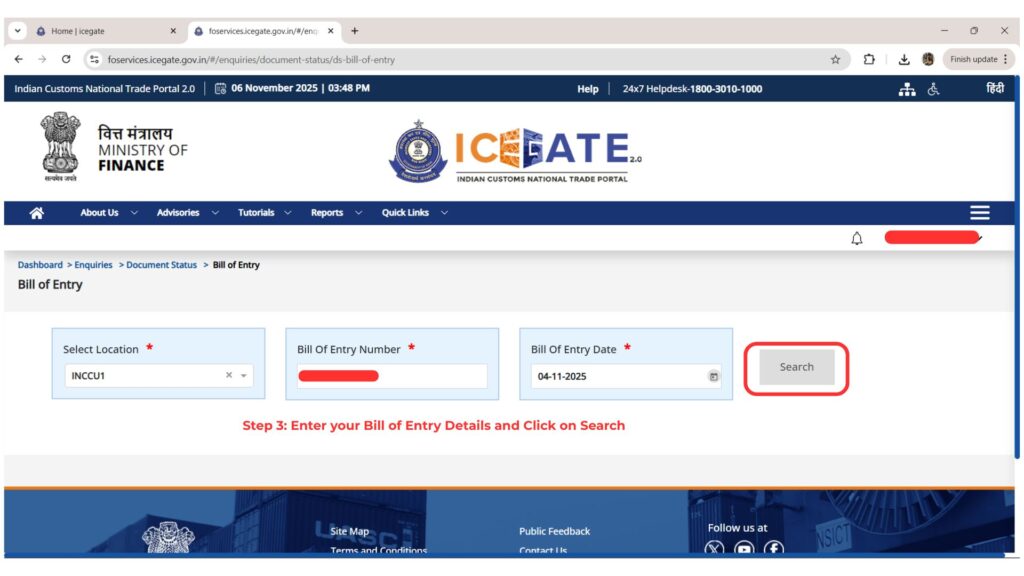

Beyond tariff elimination, the FTA streamlines customs procedures, provides a robust mobility framework for Indian professionals, and includes provisions for digital trade, intellectual property protection, and carbon compliance support.

Whether you’re an established exporter, MSME, or exploring international markets for the first time, this guide from Sunshine Cargo Services explains exactly how to leverage the India-EU FTA for business growth.