Written By Akash Gupta | Content Manager, Sunshine Cargo

Kolkata, West Bengal, India — September 2, 2025

The India-UK FTA: How New Rules will Impact Indian Customs and Imports

The landmark India-UK Free Trade Agreement (FTA) is set to reshape bilateral trade. For Indian customs agents and import businesses, this means a significant shift in rules and procedures. The deal’s new provisions on tariffs, market access, and customs processes will change how you operate. This article explains the key changes and how to navigate them effectively.

Key Takeaways

-

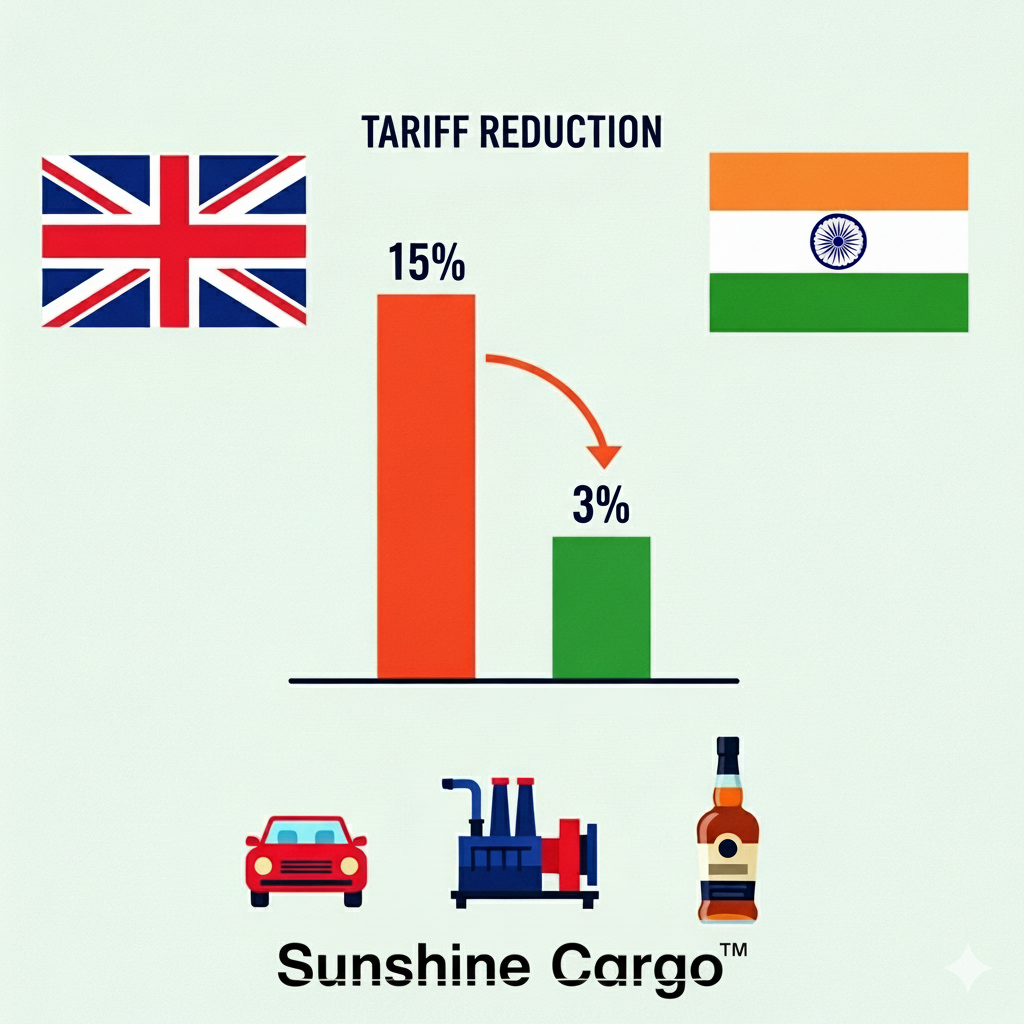

The FTA will slash average Indian tariffs on UK goods from 15% to just 3%.

-

New customs procedures will aim to release goods within 48 hours for compliant traders.

-

The deal will boost trade in key sectors like whisky, machinery, and automotive components.

Table of Contents

What is the India-UK FTA?

In short: The India-UK FTA is a new trade pact designed to reduce tariffs and non-tariff barriers, making it cheaper and easier to trade between the two countries.

Signed by Prime Ministers Narendra Modi and Keir Starmer, the Comprehensive Economic and Trade Agreement (CETA) is a major step forward. The UK’s Business and Trade Secretary, Jonathan Reynolds, announced that the deal will cut the average Indian tariff on British goods from 15% to 3%. This is a huge change. This will save businesses money, making imports from the UK more competitive. The FTA is expected to double bilateral trade to $120 billion by 2030, according to official statements.

“This agreement drops the average Indian tariff on UK products from 15% to 3%, with duties falling by around £400 million at entry, rising to £900 million after staging.” (Jonathan Reynolds, UK Business and Trade Secretary — Times of India — September 1, 2025 — [2])

The agreement is set to create greater transparency and certainty. This will boost business confidence. It will also simplify processes and reduce red tape. This makes it a landmark deal. For an overview of other major agreements shaping the global economy, see our article on India-Korea FTA CEPA.

Why the FTA Matters Now for Indian Importers

The FTA is a game-changer for Indian import businesses. Its main purpose is to make trade more efficient and cost-effective. The phased reduction of tariffs is the most immediate benefit. For example, tariffs on UK whiskies will fall from 150% to 75% initially, and then to 40% over ten years [1]. This will make UK products more affordable for Indian consumers.

In short: The FTA’s tariff cuts will lower import costs and streamline customs, directly impacting profit margins for Indian import agents.

The agreement is also designed to streamline customs procedures. It aims for a 48-hour target for releasing goods from customs, provided all documents are in order [4]. This will significantly reduce delays and storage costs. For customs agents, this means a faster turnover of shipments. It will also require a more efficient and digitized approach to documentation.

The FTA’s focus on transparency will also reduce unpredictability in customs clearance. This is a major benefit in a volatile global market. For a deeper look at global trade impacts, read about how the Israel-Iran war is going to affect India trade.

The Indian government has estimated a potential revenue loss of Rs 4,060 crore in the first year alone due to the lowered tariffs [5]. This figure highlights the scale of the duty cuts. For importers, this revenue loss for the government translates directly into savings for their clients. It will drive increased import volumes. If you’re looking for more general information on duties, see our customs duty FAQs.

How the FTA Works for Customs & Trade

The India-UK FTA works by creating a new framework for trade. It focuses on reducing barriers and simplifying processes. This benefits businesses on both sides.

Step 1: Understanding Tariff Reduction

In short: The agreement cuts tariffs on most UK goods entering India, making imports cheaper.

The FTA categorizes products for tariff reduction. Some goods, like cosmetics and certain machinery parts, will become duty-free immediately [1]. Others, like automobiles and spirits, will see duties phased out over a period of up to ten years. This tiered approach gives businesses time to adjust. It also ensures that Indian industries have protection. To qualify for these lower tariffs, products must meet specific Rules of Origin. This is a critical point for customs agents to verify.

Step 2: Navigating Rules of Origin

In short: To get a tariff cut, goods must prove they were made in the UK or India.

The FTA includes specific Rules of Origin (ROO). These rules define which goods qualify for preferential treatment. For a product to be considered “originating,” it must be either “wholly obtained” or have undergone “sufficient processing” in the UK or India. For customs agents, this means the Certificate of Origin is more important than ever. You must ensure all documentation is correct. Incorrect classification can lead to penalties or a denial of the preferential tariff.

Step 3: Leveraging Trade Facilitation

In short: The deal simplifies customs with digital and faster processes.

A key part of the FTA is the chapter on Customs and Trade Facilitation. It commits both countries to transparent procedures. It also promotes the use of electronic documents and paperless trade. A major goal is to speed up customs clearance times. The target is to release goods within 48 hours for compliant traders. For customs agents, this is a clear signal to invest in digital systems. If you’re unfamiliar with the process, our guide on the complete import, export, and customs clearance process in India is a good starting point.

Three Pillars to Maximize FTA Benefits

Indian import businesses can thrive under the new FTA. You must focus on three key areas to succeed.

Pillar 1: Strategic Sourcing & Product Analysis

To gain the most from the FTA, you must first know which products benefit most. Use tools like the Indian Customs EDI system (ICES) to track tariff codes. The Directorate General of Foreign Trade (DGFT) website will also publish detailed lists of products with new tariff rates.

Case Example: An importer of UK-made automotive parts currently pays a high tariff. Under the FTA, this duty may drop significantly. By working with their customs agent to re-evaluate their product line, they can focus on high-margin items. The agent would help them identify which specific parts are covered by the new rules. This strategic analysis helps the importer lower their landed costs. For more on sourcing, read about demurrage and detention charges and how to avoid them.

Pillar 2: Digital Compliance & Documentation

The FTA emphasizes digital trade and simplified customs. As a customs agent, your role will evolve. You need to be an expert in digital documentation. The new process will require you to submit electronic declarations. You will need to verify Certificates of Origin and other documents digitally.

The Central Board of Indirect Taxes and Customs (CBIC) is working on a new framework. This will make digital submission mandatory. Using a robust customs software like ICEGATE is a must. It will ensure you are ready for these changes. For practical guidance, see our article on how to file a customs transit declaration (CTD) on ICEGATE.

Pillar 3: Client Education & Advisory

Your clients—the importers—may not fully understand the new rules. Your value as a customs agent will be in providing expert advice. You can help them:

-

Identify new sourcing opportunities from the UK.

-

Understand the new cost structure for their imports.

-

Ensure they meet all new compliance requirements.

By becoming a trusted advisor, you build stronger relationships. This will help you retain clients. It also positions you as a leader in the new trade landscape. Learn more about the importance of this role in our guide on customs clearing and forwarding agents.

Tools & Resources for FTA Compliance

To succeed under the new FTA, you need the right tools.

-

DGFT Website: This is the official source for all trade-related updates. The site will publish the finalized FTA text and product-specific rules.

-

ICEGATE: The official portal for Indian customs e-filing. You must be registered and proficient in using this system for all your clearance work. Our article on how to respond to a BE query on ICEGATE can help with common issues.

-

CBIC Notifications: Stay up-to-date by subscribing to the Central Board of Indirect Taxes and Customs notifications. This is where changes to procedures and tariffs will be announced.

Case Study: The Automotive Import Opportunity

The automotive sector is a prime example of the FTA’s impact. India currently has tariffs of up to 100% on imported cars and automotive components [3]. The new FTA will slash these to 10% for a certain quota of vehicles [1]. This opens up a huge new market for UK-made luxury cars and high-tech parts.

An Indian importer of automotive parts, working with a savvy customs agent, could benefit immensely. The agent would first analyze the specific parts the importer wants to bring in. Then, they would check the new tariff codes. Next, they would help the importer get a Certificate of Origin from their UK supplier.

This ensures the importer pays the new, lower duty. With the help of the agent, the importer can also take advantage of faster customs clearance. This not only lowers costs but also speeds up their supply chain. This is a win for both the importer and the customs agent. This example shows why understanding the nuances of free trade agreements is critical, much like understanding the US-China tariff war and its effects on Indian businesses.

Common Mistakes to Avoid

-

Incorrect documentation: Failure to provide the correct Certificate of Origin will result in the denial of tariff benefits. The importer will be charged the higher, non-preferential duty.

-

Ignoring phased reductions: The tariff cuts are not all immediate. Assuming a product has a zero duty from day one can lead to major calculation errors and unexpected costs.

-

Underestimating digital requirements: Sticking to old, paper-based processes will cause significant delays. You must embrace digital systems to meet the new 48-hour clearance target. You can find more tips on this in our article about overcoming supply chain bottlenecks in customs clearance.

-

Failing to advise clients: If you don’t inform your clients about the changes, they may go to a competitor who does. Providing proactive advice is key to building client loyalty.

FAQs on the India-UK FTA

What is the India-UK Free Trade Agreement (FTA)?

In short: The India-UK FTA is a new pact that cuts tariffs and simplifies trade procedures. It aims to boost bilateral trade and strengthen economic ties between the two countries.

The agreement, also known as the Comprehensive Economic and Trade Agreement (CETA), was signed to reduce trade barriers. It covers a wide range of goods and services. For India, it provides duty-free access for nearly 99% of its goods to the UK market [1]. The UK, in turn, gets preferential access to India’s fast-growing economy. The deal is expected to increase bilateral trade by £25.5 billion.

How will the India-UK FTA affect import tariffs?

In short: The FTA will reduce the average tariff on UK goods from 15% to 3%. This will lead to significant cost savings for Indian importers.

The tariff reductions will be implemented in two ways. Some tariffs will be eliminated immediately upon the agreement’s entry into force. Others will be phased out over a period of time. This staged approach is designed to protect sensitive sectors in both countries. For example, tariffs on UK whiskies will be cut from 150% to 75% at first, then to 40% over ten years. This makes products from the UK more competitive in the Indian market.

What are the new customs clearance procedures under the FTA?

In short: The FTA includes a goal to release goods from customs within 48 hours for compliant traders. This will be achieved through simplified and digitized processes.

The agreement focuses on making customs procedures more transparent and efficient. It promotes the use of electronic documentation to reduce paperwork and delays. This is a key benefit for customs agents and importers. It will also reduce the need for physical inspections for traders with a good compliance record. The goal is to create a more predictable and faster trade environment.

What are the Rules of Origin, and why are they important?

In short: Rules of Origin (ROO) are the criteria used to determine where a product was made. They are crucial because only goods that meet these rules can get the FTA’s lower tariffs.

To benefit from the FTA’s preferential tariffs, a product must prove its “economic nationality.” This means it must be either “wholly obtained” in the UK or India or have undergone significant processing in one of these countries. Importers and their customs agents must ensure that all documentation, including the Certificate of Origin, is accurate to claim the tariff benefits. Failure to do so could result in the goods being subject to higher, non-preferential duties.

How will the FTA benefit Indian customs agents?

In short: Customs agents will become more valuable as experts in navigating the new rules, helping importers save money and streamline their supply chains.

The FTA presents a major opportunity for customs agents to expand their services. Instead of just handling paperwork, you will become a strategic advisor. You can help clients identify which products will benefit most from the tariff cuts. You can also guide them through the new digital documentation requirements. By mastering these new rules, you can help importers reduce costs, speed up delivery times, and gain a competitive edge. This will strengthen your client relationships and grow your business. For an example of how your role extends to other areas, read about the advantages and disadvantages of different types of transport in customs.

Conclusion

The India-UK FTA is a new chapter in global trade. It promises to boost bilateral trade and lower costs for importers. For Indian customs agents, this is a chance to move from a transactional role to a strategic one. By mastering the new rules, investing in digital tools, and advising clients, you can thrive in this new landscape. The future of trade is here.

Ready to master the new FTA? Contact our experts today to ensure your imports are compliant and cost-effective.

Sources & Backlinks

-

UK-India trade deal: conclusion agreement summary — GOV.UK — July 24, 2025 — https://www.gov.uk/government/publications/uk-india-trade-deal-conclusion-summary/uk-india-trade-deal-conclusion-summary

-

India-UK FTA: Pact to cut tariffs and strengthen business confidence; what British Parliament was told — Times of India — September 1, 2025 — https://timesofindia.indiatimes.com/business/international-business/india-uk-fta-pact-to-cut-tariffs-and-strengthen-business-confidence-heres-what-uk-parliament-told/articleshow/123640633.cms

-

The UK-India Free Trade Agreement — Dentons — May 8, 2025 — https://www.dentons.com/en/insights/articles/2025/may/8/the-uk-india-free-trade-agreement

-

UK-INDIA COMPREHENSIVE ECONOMIC & TRADE AGREEMENT: A NEW ERA FOR UK TRADE & CUSTOMS — Cooper Parry — https://www.cooperparry.com/news/uk-india-free-trade-agreement-a-new-era-for-uk-trade-customs/

-

India-UK FTA: Rs 4060 crore hit in first year; customs revenue loss to widen by 10th year — Times of India — July 28, 2025 — https://timesofindia.indiatimes.com/business/india-business/india-uk-fta-rs-4060-crore-hit-in-first-year-customs-revenue-loss-to-widen-by-10th-year/articleshow/122951147.cms