Published by: Akash Gupta, Sunshine Cargo Services

Publication Date & Location: 10th February, 2026 ; Kolkata, India

Last Updated: 10th February, 2026

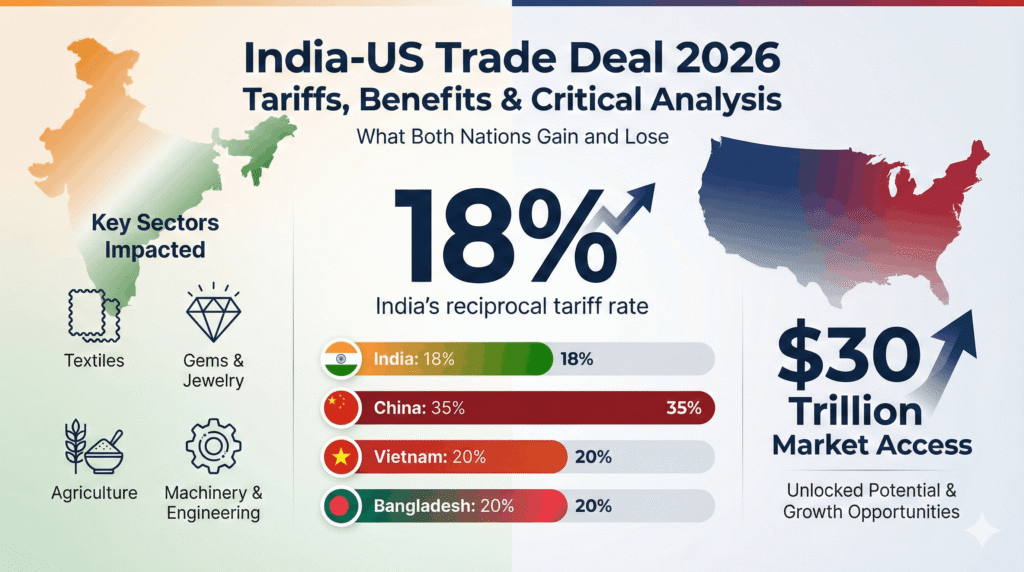

The India-United States Bilateral Trade Agreement, announced in February 2026, represents one of the most significant economic agreements in recent bilateral trade history. This interim framework agreement unlocks preferential access for Indian goods to a $30 trillion U.S. market while establishing reciprocal commitments that reshape trade dynamics between the world’s largest economy and its fastest-growing major economy.

What is the India-US Trade Deal?

The India-US Trade Deal is an interim bilateral agreement that reduces tariff barriers between the two countries and establishes a framework for enhanced market access. Under this agreement, India receives a preferential reciprocal tariff rate of 18% on most goods entering the United States, down from previous rates as high as 50%. The U.S. eliminates tariffs entirely on specific categories including generic pharmaceuticals, gems and diamonds, and aircraft parts. In exchange, India eliminates or reduces tariffs on U.S. industrial goods and agricultural products including tree nuts, processed fruits, soybean oil, wine, and spirits.

This framework serves as a foundation for the broader Bilateral Trade Agreement (BTA) currently under negotiation. The deal covers approximately $86.35 billion in current Indian exports to the United States and establishes rules of origin, addresses non-tariff barriers, and commits both nations to digital trade cooperation.

How the Tariff Restructuring Works

Major Relief on Reciprocal Tariffs

Of India’s $86.35 billion in exports to the United States in 2024, $40.96 billion were subject to reciprocal tariffs. The agreement restructures these as follows:

- $30.94 billion in exports see tariffs reduced from 50% to 18%

- $10.03 billion in exports receive zero-tariff access (reduced from 50%)

- $1.04 billion under exemption category maintains zero reciprocal duty

- $28.30 billion under Section 232 provisions gains zero additional duty access

This creates substantial cost advantages for Indian exporters across textiles, leather, machinery, and consumer goods sectors.

Competitive Positioning Against Other Exporters

The agreement creates differential tariff treatment favoring India over competing Asian suppliers. While Indian goods face an 18% reciprocal tariff, competitors face higher rates:

- China: 35%

- Vietnam: 20%

- Bangladesh: 20%

- Malaysia, Indonesia, Philippines, Cambodia, Thailand: 19%

This 1-17 percentage point advantage significantly enhances India’s price competitiveness in the U.S. market, particularly in labor-intensive manufacturing sectors where margins are sensitive to tariff differentials.

Suggested Read: The India-EU Free Trade Agreement (FTA) 2026

What India Gains from the India US Trade Deal

Textile and Apparel Sector Benefits

Tariffs on textile exports drop from 50% to 18%, with silk receiving 0% duty access. This opens enhanced opportunities in a U.S. market valued at $113 billion. Major categories benefiting include readymade garments, carpets, man-made and cotton textiles, bedspreads, yarn, baby clothing, bed linen, blankets, and gloves.

Given India’s substantial textile production capacity and competitive labor costs, this tariff reduction positions Indian manufacturers to capture market share from competitors facing higher duties. The textile sector employs millions across India’s production clusters, making this particularly significant for employment generation.

Leather and Footwear Market Access

Tariff reductions from 50% to 18% provide improved access to a $42 billion U.S. leather and footwear market. India’s labor-intensive leather industry, concentrated in states like Tamil Nadu and Uttar Pradesh, stands to benefit substantially. The agreement covers finished leather, leather footwear, and footwear components.

This positions India as a preferred supplier against competitors like Vietnam and China, which face higher tariff barriers in the U.S. market.

Gems and Jewelry Sector Advantages

The agreement reduces tariffs from 50% to 18% on gems and jewelry, providing access to a $61 billion U.S. market. Additionally, 0% duty access applies to diamonds, platinum, and coins covering a $29 billion market segment.

India dominates global diamond cutting and polishing, processing approximately 90% of the world’s diamonds by volume. Zero-duty access for cut and polished diamonds, lab-grown diamonds, and colored gemstones strengthens India’s competitive position in this high-value sector.

Machinery and Industrial Exports

Machinery tariffs drop from 50% to 18%, opening opportunities in a $477 billion U.S. market. India’s current machinery exports to the U.S. stand at $2.35 billion, indicating substantial growth potential. This supports India’s manufacturing ambitions and efforts to expand value-added industrial exports.

Agricultural Export Opportunities

The United States grants zero additional duty access to $1.36 billion in Indian agricultural exports. Beneficiary products include:

- Spices (India saw 88% growth in spice exports in 2024-25)

- Tea and coffee extracts

- Coconut and coconut oil

- Tree nuts (areca, Brazil nuts, cashews, chestnuts)

- Fruits (avocados, bananas, guavas, mangoes, kiwis, papayas, pineapples)

- Mushrooms

- Processed products (fruit pulp, juices, jams)

- Bakery products

- Sesame and poppy seeds

Within this, $1.035 billion receives assured zero reciprocal tariff treatment, providing stability for Indian farmers and agricultural exporters. India maintains a $1.3 billion agricultural trade surplus with the United States ($3.4 billion in exports versus $2.1 billion in imports).

Industrial Exports with Zero-Duty Access

The agreement secures zero additional duty for $38 billion in industrial exports under Section 232 provisions and other categories:

- Aircraft parts

- Generic drugs and pharmaceutical ingredients

- Elementary auto parts

- Gems and diamonds

- Clocks and watches

- Essential oils

- Home décor items (chandeliers, illuminated signs)

- Inorganic chemicals

- Instruments and apparatus

- Minerals and natural resources

- Natural rubber

Home Décor and Consumer Goods

Tariffs on home décor exports reduce from 50% to 18%, accessing a $52 billion U.S. market. Products include wood furniture, pillows, cushions, quilts, non-electrical lamps, and furnishing products. Additionally, 0% duty access covers $13 billion in products including seats, chandeliers, and illuminated signs.

Toys and MSMEs

Toy export tariffs drop from 50% to 18%, providing access to an $18 billion U.S. market. This creates opportunities for domestic manufacturers, particularly MSMEs, to scale production and integrate into global supply chains.

What India Concedes in the Trade Deal

Industrial Goods Market Opening

India eliminates or reduces tariffs on U.S. industrial goods across multiple categories. Market access is structured through immediate elimination, phased reduction over up to ten years, and quota-based access depending on product sensitivity.

Sensitive sectors receive calibrated safeguards:

- Automobiles: Liberalized through quota and duty reduction combinations

- Medical devices: Long, staggered phasing schedules

- Precious metals: Quota-based tariff lowering

Agricultural Product Imports

India provides market access to select U.S. agricultural products while maintaining protections for sensitive sectors:

Liberalized categories include:

- Tree nuts (in-shell almonds, walnuts, pistachios under tariff rate quotas)

- Fresh and processed fruits (berries)

- Niche oils

- Wine and spirits

- Soybean oil

- Dried distillers’ grains (DDGs)

- Red sorghum for animal feed

- Select processed foods

Phased elimination (up to 10 years) applies to:

- Albumins

- Certain oils (coconut oil, castor oil, cotton seed oil)

- Modified starches

- Plant materials used in food processing

Immediate elimination applies only to:

- Non-sensitive products already liberalized under other FTAs

Consumer-Oriented Imports

The agreement enables calibrated access to consumer products that supplement domestic supply:

- Tree nuts

- Berries and processed fruits

- Premium beverages

- Select pet food products

- Frozen fish (salmon, cod, Alaska pollock)

- Yeast, margarine, abalone

Intermediate Goods and Technology Inputs

India facilitates access to critical inputs for manufacturing:

- Rough diamonds and precious stones

- Specialty chemicals for pharmaceuticals

- Active pharmaceutical ingredients

- Semiconductor wafers and fabrication inputs

- Electronics components (IC substrates, sensors, microcontrollers)

- Carbon fibers

- Industrial enzymes

- Aerospace components

- Battery materials (lithium compounds, cathode materials)

- Fertilizer inputs (phosphate rock, potash)

High-Technology Imports

The agreement supports technology advancement by facilitating access to:

- Advanced medical devices (diagnostic imaging, surgical robotics)

- AI chips and high-performance processors

- Semiconductor manufacturing equipment

- Cloud computing infrastructure hardware

- Telecom and ICT network equipment

- Clean energy technologies

- Biotechnology research equipment

- Data center infrastructure equipment

Non-Tariff Commitments

India commits to addressing several non-tariff barriers:

Medical devices: Remove long-standing barriers to U.S. medical device trade

ICT goods: Eliminate restrictive import licensing procedures that delay market access or impose quantitative restrictions

Standards alignment: Determine within six months whether U.S.-developed or international standards are acceptable for U.S. exports in identified sectors

Agricultural products: Address long-standing non-tariff barriers to U.S. food and agricultural products

Conformity assessments: Discuss standards and conformity assessment procedures for mutually agreed sectors

Purchase Commitments

India intends to purchase $500 billion in U.S. goods over five years:

- Energy products

- Aircraft and aircraft parts

- Precious metals

- Technology products

- Coking coal

- Graphics Processing Units (GPUs) and data center equipment.

Suggested Read: Union Budget 2026 – Complete Customs Overhaul Full Analysis