Note: This article is based on the GST rate notification and official information available as of September 22, 2025. It is for informational purposes only and does not constitute financial or legal advice. Please consult a qualified tax professional for specific guidance.

By Akash Gupta | AI Generalist & Content Specialist, Sunshine Cargo Services

Kolkata, West Bengal, India — September 22, 2025

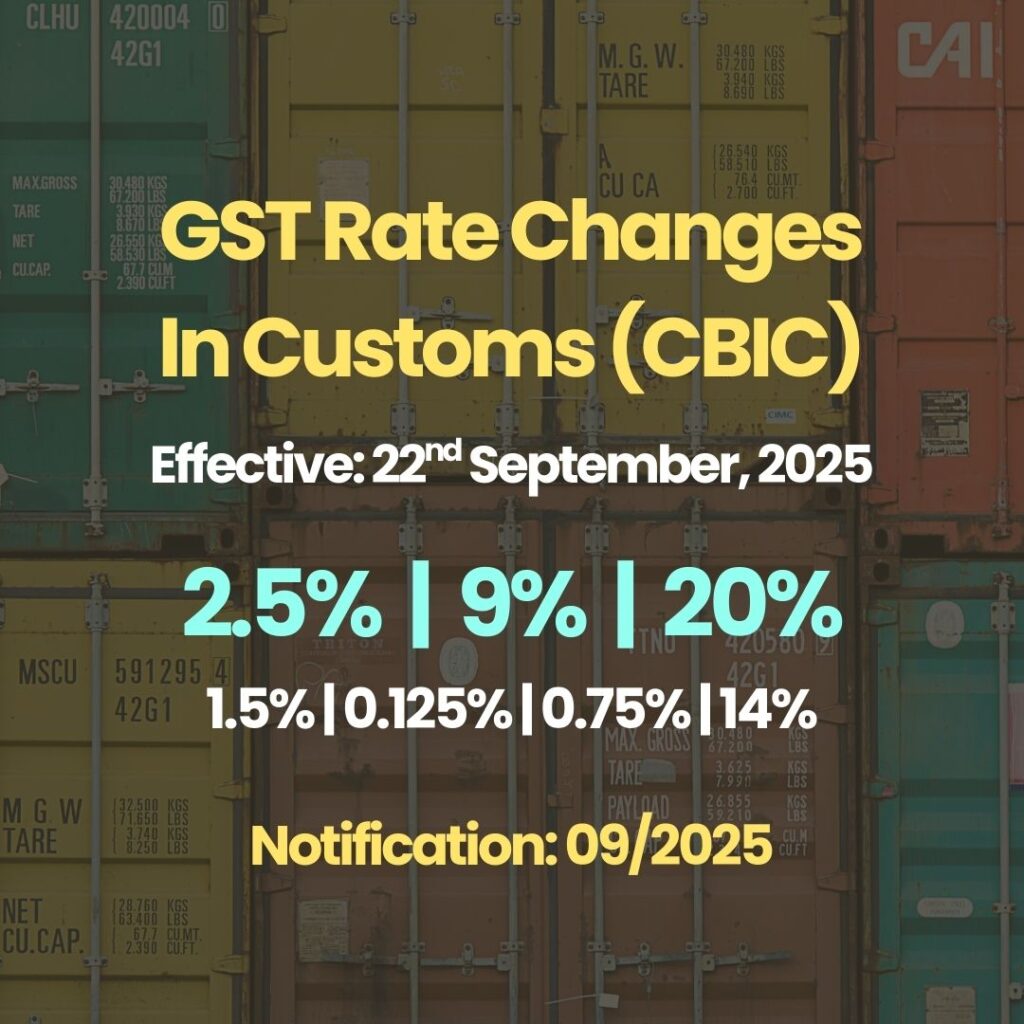

The CBIC has introduced significant changes to the GST framework with Notification No. 9/2025-Central Tax (Rate). This new GST new rate structure, effective from September 22, 2025, replaces the previous multi-slab system with a more detailed seven-tier framework.

This reform is a key outcome of the 56th GST Council meeting, which aimed to simplify taxes and provide relief to consumers and businesses.

What’s Changed in the GST Rate Notification 09/2025?

The new notification, which supersedes the one from June 2017, restructures GST into seven distinct schedules, each with a specific Central Tax (CGST) rate.

Schedule I: 2.5%

Schedule II: 9%

Schedule III: 20%

Schedule IV: 1.5%

Schedule V: 0.125%

Schedule VI: 0.75%

Schedule VII: 14%

The corresponding State GST (SGST) rates for intrastate supplies will be mirrored by state governments, while a separate notification covers the Integrated GST (IGST) for interstate transactions.

This structure is a more granular approach to the GST Council’s initial recommendation of a simplified two-rate structure (5% for essentials and 18% for most others).

Table of Contents

What Is the New CBIC GST Rate Notification?

Why the New GST Rates Matter Now

How the New GST Structure Works

Three Pillars of the New GST Framework

Tools & Resources for Businesses

Common Mistakes to Avoid

FAQs About the New GST Rates

Conclusion

What Is the New CBIC GST Rate Notification?

In short: The new CBIC notification is a major overhaul of India’s GST system, replacing the old four-tier structure with seven new rate schedules.

On September 17, 2025, the Ministry of Finance released Notification No. 9/2025-Central Tax (Rate). It supersedes the previous rate notification from June 28, 2017. This new notification introduces a revised rate structure with seven different tax slabs. The new system aims to simplify the tax framework and correct past anomalies.

The notification specifies tax rates for intra-State supplies of goods. It groups goods into seven schedules, each with a different central tax rate. This reform is a step towards making the GST system more efficient.

The Harmonised System of Nomenclature (HSN) and tariff item codes, as defined in the Customs Tariff Act, 1975, are used to classify goods under the new GST framework. This linkage helps in clear product categorization, which is a key goal of the reform.

Why the New GST Rates Matter Now

In short: The new rates are part of a broader reform aimed at simplifying taxes and reducing costs for consumers.

The changes come after the 56th GST Council meeting on September 3, 2025. The council recommended a streamlined two-rate structure, a 5% rate for essential goods and an 18% standard rate for most other items.

The new, seven-tiered system reflects this simplification in a more detailed way. It’s a move to make things easier. For instance, some reports suggest a middle-class family could save up to ₹600 on their monthly grocery bill due to these changes.

According to the provided notification, the Central Government, on the recommendations of the GST Council, “hereby notifies the rate of central tax” for the goods in the new schedules. This action formalizes the changes and makes them law.

This new system also corrects the “inverted duty structure,” which had been a problem for some businesses. By lowering rates on raw materials and inputs, the new structure aims to reduce costs and boost competitiveness for Indian industries and exporters.

How the New GST Structure Works

The new system is based on seven rate schedules. Each schedule has a different tax rate. This replaces the simpler, but often confusing, four-slab system. The new framework allows for more specific tax rates on different types of goods.

Schedule I: The 2.5% Slab In short: This schedule covers essential goods like food products, animal products, and agricultural items.

This is the lowest rate and applies to a wide range of everyday essentials. It includes pre-packaged and labeled goods like flour, rice, and dried nuts. It also covers agricultural machinery and medical devices, making them more affordable for farmers and the public.

Schedule II: The 9% Slab In short: This schedule applies to many industrial goods, building materials, and consumer durables.

The 9% slab acts as a standard rate for many common products. It includes goods like petroleum coke, various metals, and certain electrical appliances. This rate also applies to many types of footwear and apparel with a sale value exceeding ₹2500 per piece.

Schedule III: The 20% Slab In short: This schedule is for high-end or non-essential goods, including luxury items and certain motor vehicles.

Items like motor cars with large engine capacities, private aircrafts, and yachts fall under this category. This is a higher tax bracket aimed at luxury consumption. The notification also includes items like betting and gambling under this rate.

Three Pillars of the New GST Framework

The new framework is built on three key ideas. These ideas are designed to simplify and improve the tax system. This new structure is meant to be more transparent.

Simpler Classification The new system groups goods into schedules. This is based on their classification under the Customs Tariff Act, 1975. This approach is meant to reduce confusion. Businesses can more easily find the correct tax rate for their products. This makes compliance simpler.

Lowering the Tax Burden The new rates are designed to lower costs for consumers. Many essential goods have been moved to lower tax brackets. For example, some dairy products, dry fruits, and processed foods have seen their GST rates drop significantly. This change is a big win for the average household. It is expected to save families money on their weekly grocery bills.

Boosting Industries By reducing GST rates on certain raw materials and finished goods, the government aims to help domestic industries. For example, rates on agricultural machinery, certain textiles, and some medical devices have been reduced. This correction of the inverted duty structure will help manufacturers and exporters. It supports the “Make in India” initiative.

Tools & Resources for Businesses

The transition to the new GST rates requires careful planning. Businesses can use several tools to manage the change. A good tax professional can help with this. You can also use official GST portals. The government is also planning to introduce auto-refunds and pre-filled returns for some businesses. This will reduce administrative work.

Official GST Portal: Check the official CBIC website for all notifications and FAQs.

ERP System Updates: Make sure your accounting software is updated to reflect the new rates.

Professional Tax Advisors: A tax expert can help you correctly classify your goods and avoid errors.

For a detailed analysis, consider reaching out to a tax advisory firm.

Common Mistakes Businesses Make

Not updating billing systems: Failing to change your point-of-sale or accounting software can lead to incorrect invoicing.

Misclassifying goods: Just because a product is similar to one on a list doesn’t mean it has the same rate. Check the HSN code carefully.

Not passing on the benefits: A failure to reduce prices after a tax cut can lead to consumer backlash and legal issues. The National Anti-profiteering Authority (NAA) monitors this.

Ignoring new rules: The new notification supersedes the old one. This means you must follow the new rules, not the old ones.

FAQs About the New GST Rates

What are the new GST rates in India? The new GST rates are part of a seven-tier system, including 0.125%, 0.75%, 1.5%, 2.5%, 9%, 14%, and 20% central tax rates. This structure replaces the previous four-slab system. It came into effect on September 22, 2025.

Why did the government introduce new GST rates? The government’s goal is to simplify the GST system and reduce tax burdens on everyday items. The new structure also aims to correct anomalies, like the inverted duty structure, and boost domestic industries.

How do the new GST rates for customs affect me? The new notification relates to the Central Goods and Services Tax (CGST) and is for goods supplied within India. However, the classification of goods is based on the Customs Tariff Act, 1975. This ensures consistency in how products are defined for tax purposes.

What is the new GST rate for pre-packaged and labelled food items? Many pre-packaged and labelled food items now fall under the 2.5% GST slab. This includes items like dried fruits, flour, and some dairy products. This change is intended to make everyday groceries more affordable for consumers.

Is my business required to update its ERP and billing software? Yes, businesses must update their Enterprise Resource Planning (ERP) and billing systems. This is necessary to ensure that the correct GST rates are applied to all transactions.

What is the new GST rate for motor vehicles? GST rates on small cars and two-wheelers up to 350cc have been reduced from 28% to 18%. High-end motor vehicles, however, are now in the 20% slab.

Are there any new exemptions under the new GST framework? Yes. Health and life insurance premiums are now fully exempt from GST. Additionally, many essential educational supplies like pencils and notebooks are now tax-free.

Conclusion

The new GST rate structure, effective September 22, 2025, represents a significant step forward in India’s tax reform. By introducing a seven-tier system, the government aims to simplify compliance for businesses and lower prices for consumers. For businesses, staying updated on the new rates and classifications is essential to ensure smooth operations. For consumers, this change means potential savings on everything from daily groceries to new cars and even health insurance premiums. This new system is set to transform the way we transact.

Want someone to take over all your import hassle and headache? Contact us today!

Sources & Backlinks

CBIC-N-No.-9-2025-Central-Tax-Rate.pdf– Central Board of Indirect Taxes & Customs – September 17, 2025New GST rates from today, September 22: Check the full list to see what’s cheaper and what’s costlier– The Economic Times – September 22, 2025 –https://m.economictimes.com/news/

india/new-gst-rates-from-today-september-22-check-the-full-list-to-see-whats-cheaper-and-whats-costlier/articleshow/124036544.cmsCentral Tax (Rate) Notification 9/2025: New GST Rates and HSN Codes– SAG Infotech Blog – September 18, 2025 –https://blog.saginfotech.com/central-tax-rate-notification-9-2025-new-gst-rates-hsn-codesGST 2.0: Key changes effective September 22; explained in FAQs– The Economic Times – September 16, 2025 –https://m.economictimes.com

/news/economy/policy/

gst-2-0-key-changes-effective-september-22-explained-in-faqs/articleshow/

123915781.cms

sunshine cargo services

private limited

Head Office Address:

Marshall House, Room 574, 33/1, N.S. Road/25, Strand Road, Kolkata West Bengal 700001

Contact:

Deepak Kumar: +91-98300-66760

Manish Kumar: +91-98363-29801

Email:

su************@***oo.com

Working Hours:

Monday-Friday: 10:00 AM to 18:00 PM

Saturday: 10:00 AM to 14:00 PM

Closed on Sundays and Indian Government Holidays.

Service Offices:

Raxaul, Bihar, India

Jogbani, Bihar, India

All Rights Reserved by Sunshine Cargo Services Private Limited.

Developed by FresioMedia.