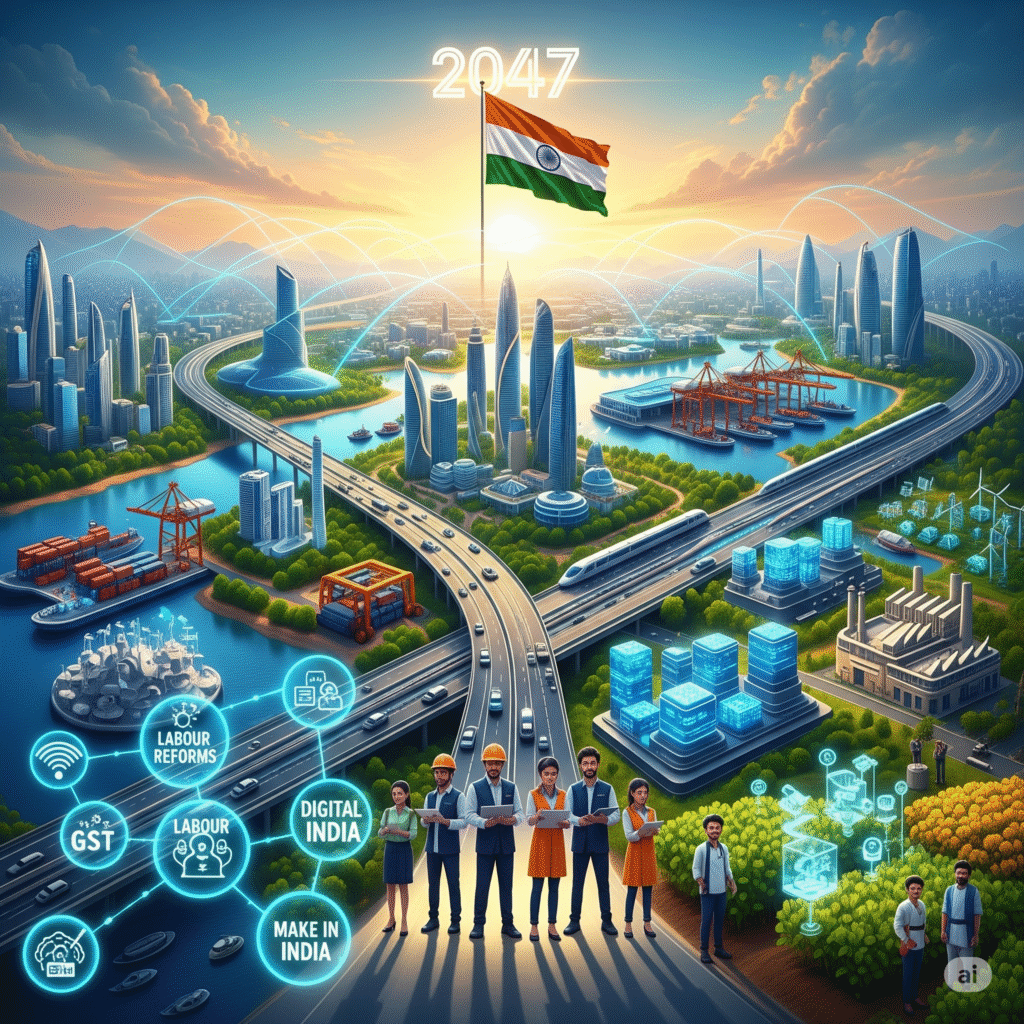

Viksit Bharat 2047 and the Urgency for Structural Reforms

India today stands at a decisive moment in its economic journey. With a GDP of nearly $4 trillion in 2025, the country has already become the fifth-largest economy in the world, but the long-term vision goes far beyond this milestone. By 2047 — the year India celebrates 100 years of independence — the government has set a national mission to achieve the status of a developed economy under the vision of Viksit Bharat 2047.

This ambitious roadmap is not just about scaling GDP numbers; it is about creating a globally competitive, resilient, and inclusive economy. A developed India by 2047 means:

A per capita income of at least $20,000+, comparable with today’s developed nations.

A thriving manufacturing base that competes with China, South Korea, and developed Western markets.

A services sector that not only powers IT and digital exports but also strengthens tourism, healthcare, and financial services.

A globally integrated trade ecosystem, making India a preferred supply chain hub.

Robust infrastructure — from expressways to smart ports — that lowers the cost of logistics and trade.

But here lies the challenge: to unlock this vision, India needs a new generation of reforms.

Why Reforms Are Critical for Viksit Bharat 2047

India’s current policy framework, though significantly modernized since 1991 liberalization, still suffers from inefficiencies. Complex tax structures, rigid labour laws, fragmented logistics, and tariff-related trade barriers continue to restrict India’s potential.

According to the Confederation of Indian Industry (CII) reform roadmap (2025), if India carries out a coordinated set of reforms in GST, trade, labour, logistics, and investment policies, it could accelerate GDP growth from the current 6.5% average to 8–9% annually. Sustained over two decades, this growth trajectory would push India into the developed economy bracket by 2047.

CII President Sanjiv Puri noted in the report:

“India has the opportunity to become the world’s third-largest economy within this decade, but to sustain momentum till 2047, deep structural reforms are the need of the hour.” (Source: Times of India)

This highlights that reforms are not optional; they are essential. Without simplifying taxation, boosting exports, modernizing customs clearance, and ensuring flexible labour markets, India risks plateauing at middle-income status.

What This Blog Will Explore

In this blog, we will break down the CII reform roadmap for Viksit Bharat 2047 into practical, easy-to-understand sections. We’ll look at:

GST reforms: Why rationalizing rates and digitizing compliance could add billions to GDP.

Trade and tariff reforms: How reducing barriers and modernizing customs could boost exports.

Labour law reforms: Why India needs to balance job creation with workforce flexibility.

Logistics modernization: How reducing supply chain costs can make Indian exports globally competitive.

Investment & policy reforms: What it will take to attract global investors and empower MSMEs.

Along the way, we’ll connect these reforms with real-world case studies, global comparisons, and policy insights to show what India can learn from other economies like South Korea, Singapore, and China.

By the end, you’ll have a comprehensive view of how structural reforms in GST, trade, labour, and logistics will decide whether India truly becomes a developed nation by 2047 — or misses the opportunity.

GST Reforms: Simplification, Rate Rationalization, and Digital Compliance

The Goods and Services Tax (GST), launched in 2017, is often described as India’s most significant tax reform since liberalization. It replaced a complex web of central and state taxes with a unified structure, aiming to create a seamless national market. However, after nearly eight years of implementation, industry bodies like CII argue that GST still requires structural reforms to align with India’s Viksit Bharat 2047 vision.

Why GST Reform is Crucial for India’s Growth

Currently, India’s GST system is fragmented into multiple rate slabs (0%, 5%, 12%, 18%, 28%). While intended to balance affordability and revenue, this system has created confusion, litigation, and compliance burdens for businesses.

Economists point out that GST in its current form does not fully deliver on its original promise of being a “Good and Simple Tax.” Rate anomalies, frequent clarifications, and complicated input credit rules add to trade inefficiencies.

If rationalized and simplified, GST could:

Boost GDP by 1–1.5% annually, according to NCAER studies.

Improve ease of doing business for small and medium enterprises (SMEs).

Reduce litigation and compliance costs.

Attract global manufacturers who currently face better tax systems in Southeast Asia.

GST Rate Rationalization – One Nation, One Tax in Practice

One of the biggest recommendations from the CII roadmap is rate rationalization.

Currently, India’s GST rates create confusion. For example:

Some food products are taxed at 5%, while processed versions attract 12% or 18%.

Electronics like smartphones are at 12%, but accessories go up to 28%.

Services like hotels and restaurants have different slabs, complicating consumer pricing.

The CII suggests converging these slabs into three rates (low, standard, and high). This would not only simplify the system but also reduce tax evasion and disputes.

Case in point: Countries like Singapore and Malaysia operate with a single or dual GST/VAT rate, making compliance much easier for businesses. India, as an emerging global hub, cannot afford a system that confuses investors.

Digital Compliance and E-Invoicing

Another pillar of GST reform is digitization of compliance. India has already introduced e-invoicing and GSTN filings, but challenges remain.

Many SMEs struggle with frequent return filings (GSTR-1, GSTR-3B, annual returns).

IT glitches in GSTN continue to frustrate businesses.

Refund delays, especially for exporters, tie up working capital.

The solution lies in automation and AI-driven GST compliance. For example:

Pre-filled GST returns could reduce manual errors.

Real-time credit reconciliation would stop fraud in input tax claims.

Integration of GSTN with ICEGATE customs systems could make export-import trade faster.

This aligns with India’s push for digital public infrastructure (DPI), where platforms like UPI have already transformed payments. A truly AI-enabled GSTN could do the same for tax compliance.

GST and International Trade

GST is also critical to India’s export competitiveness. High refund delays often force exporters to block working capital, reducing their ability to compete globally.

According to a recent World Bank report, logistics and tax-related inefficiencies add nearly 14% to India’s export costs, compared to just 8–9% in China and Vietnam. Simplifying GST refunds for exporters could directly increase India’s trade share.

(If you’re interested in how trade reforms directly impact businesses, you can also read our detailed guide on the India–Korea Free Trade Agreement CEPA and how it reduces tariffs.)

Expert Opinion

CII President Sanjiv Puri emphasized:

“Rationalization of GST rates, simplification of compliance, and better integration of tax systems will be a cornerstone for India’s growth story towards Viksit Bharat 2047.” (Times of India)

Key Takeaways on GST Reform

One Nation, One Tax in spirit requires rate rationalization.

Digital GST compliance will ease burdens for SMEs and exporters.

Faster refund processing is essential to boost international trade.

Reforms could add 1–1.5% GDP growth annually, making GST a true enabler of the Viksit Bharat mission.

Trade and Tariff Reforms – Building a Competitive Export Ecosystem

India’s ambition of becoming a $7 trillion economy by 2030 and achieving the Viksit Bharat 2047 vision hinges on its ability to become a global export hub. While India has made steady progress, its share in global merchandise trade is still below 2%, compared to China’s 14%. For India to scale up, trade and tariff reforms must focus on creating a level playing field for exporters while reducing bottlenecks in customs, tariffs, and logistics.

Why Trade and Tariff Reform is Critical

Despite government initiatives like Production-Linked Incentive (PLI) schemes and new Free Trade Agreements (FTAs), India’s exporters often face challenges such as:

High tariff structures compared to ASEAN peers.

Cumbersome customs procedures and delays at ports.

Unpredictable trade policy shifts (tariffs, bans, export duties).

Logistics costs that are nearly 2x higher than in China or Vietnam.

Unless addressed, these factors could prevent India from becoming a true global supply chain alternative.

Rationalizing Tariffs – Competing Globally

Indian tariffs on manufactured goods average between 10–15%, while many competing countries operate at 5–7%. For industries like electronics, chemicals, and machinery, this makes imported inputs more expensive, reducing export competitiveness.

The Confederation of Indian Industry (CII) recommends reducing tariffs on critical raw materials and intermediates to align India with ASEAN averages. For example:

Steel and aluminum duties are often raised to protect domestic producers, but this increases costs for auto and infrastructure exporters.

Electronics components, especially semiconductors and batteries, face high duties, raising costs for India’s fast-growing EV sector.

A more predictable tariff structure, aligned with global value chain needs, would help India integrate with global manufacturing networks.

Customs Modernization and Ease of Doing Trade

Tariff rationalization alone is not enough — customs reform is equally critical. India’s customs processes have improved through ICEGATE, faceless assessments, and single-window clearance, but issues remain:

Delays due to document mismatches.

Inconsistent enforcement of rules across ports.

Lengthy dispute resolution for tariff classification.

CII recommends building a truly paperless and AI-driven customs system, where filings, queries, and assessments are automated. Integration of ICEGATE with GSTN would further streamline processes for exporters and importers.

For example, filing a Bill of Entry amendment currently requires multiple steps. Our guide on how to file a BE amendment on ICEGATE explains the challenges businesses face — reforms can make such processes seamless.

Trade Agreements and Market Access

India has signed major agreements like the India–UAE CEPA and the India–Australia ECTA, while negotiations continue with the EU, UK, and GCC.

However, the India–Korea CEPA experience highlights the importance of balanced agreements. While Indian auto and electronics manufacturers benefit from cheaper imports, domestic steel producers have raised concerns about rising competition from Korean suppliers.

(For more on this, check our detailed analysis on the India–Korea Free Trade Agreement CEPA).

The next step for India is ensuring FTAs are balanced, protecting vulnerable domestic sectors while giving exporters greater access to global markets.

Logistics and Trade Infrastructure

India’s logistics costs currently account for nearly 13–14% of GDP, compared to 8–9% in China. This makes Indian exports less competitive in price-sensitive markets.

Key reforms include:

Expanding the Dedicated Freight Corridors (DFCs) to reduce transport time.

Boosting investment in coastal shipping and inland waterways.

Modernizing ports with digitized clearance and warehousing.

Encouraging multi-modal transport integration (air, sea, and road cargo).

Efficient logistics will directly lower export costs and improve India’s position as a global supply chain hub.

Expert Perspective

According to Sanjiv Puri, CII President:

“For India to emerge as a reliable global trading partner, tariff and customs reforms must go hand in hand with logistics efficiency and modern FTAs. This will unlock the true potential of Indian exporters.” (Times of India)

Key Takeaways on Trade and Tariff Reforms

Reduce tariffs on critical raw materials and components to align with ASEAN levels.

Digitize customs fully, eliminating delays and disputes.

Negotiate balanced FTAs to boost market access without hurting local industries.

Lower logistics costs through infrastructure upgrades and multi-modal systems.