Disclaimer: This article is for educational purposes and public interest only. The information here is based on official government statements, verified trade reports, IMF data, and reputed media publications like Reuters, Bloomberg, and Financial Times. We do not claim ownership of any official content. Currency policies and trade agreements are subject to change. For the latest updates, always refer to RBI, IMF, and BRICS summit declarations.

Introduction

Is the US dollar’s dominance under threat?

Over the last few years, the BRICS bloc (Brazil, Russia, India, China, South Africa — now expanded to BRICS+) has been actively discussing alternatives to the dollar in global trade. From oil purchases in yuan to India settling imports in rupees, the idea of a “BRICS currency” has gained massive attention worldwide.

But here’s the verified truth: there is no official BRICS currency yet. Instead, the movement is toward de-dollarization — reducing dependency on the dollar by trading in local currencies.

In this blog, we’ll cover:

What the BRICS currency idea is (and isn’t)

Why BRICS wants to challenge the US dollar

How India, China, and others are already reducing dollar use

The growing role of the Indian Rupee in global trade settlements

Advantages, disadvantages, and expert insights on the future of BRICS vs the dollar

By the end, you’ll know the facts, not just the hype.

What Is the BRICS Currency Idea?

The BRICS currency is a proposed initiative to create a new reserve currency backed by BRICS economies. The concept was first floated more than a decade ago but gained traction after Russia’s exclusion from SWIFT in 2022 during the Ukraine war.

2023 Johannesburg Summit: Leaders discussed a common settlement mechanism. However, South Africa’s Finance Minister Enoch Godongwana confirmed there was no immediate plan for a single BRICS currency, only agreements to expand trade in local currencies.

BRICS Expansion (2024): The bloc added new members like Saudi Arabia, UAE, Egypt, and Iran — increasing its economic weight. This revived discussions of a potential future currency system.

Key Fact: According to the IMF, the dollar still makes up ~58% of global foreign exchange reserves and ~42% of SWIFT payments (as of 2024). This dominance makes replacing it extremely difficult in the short term.

So, for now, the “BRICS currency” remains an idea, not a reality — but local currency trade settlements are already reshaping the global financial system.

Why Does BRICS Want to Challenge the US Dollar?

In simple terms: because the US dollar gives America too much power.

1. Dollar Dominance Creates Dependence

Around 80% of global trade is invoiced in USD (UNCTAD data).

Emerging economies face currency volatility whenever the US Federal Reserve hikes interest rates.

2. Protection from Sanctions

Russia’s exclusion from the SWIFT payment system showed BRICS nations how vulnerable they are to dollar-based sanctions.

A BRICS mechanism reduces the risk of Western financial blockades.

3. Reduce Import Costs

Dollar fluctuations impact import bills.

Local currency trade reduces forex risk.

4. Political Independence

Leaders like President Lula da Silva (Brazil) have openly called for an alternative:

“Every night I ask myself why all countries are tied to the dollar for trade. Why can’t we trade in our own currencies?”

5. Balance Global Trade Power

With BRICS+ accounting for over 32% of global GDP (World Bank, 2024), the bloc wants a stronger voice in the financial order.

This shift is similar to how India–Korea CEPA reshaped bilateral trade by reducing tariffs (read full guide here).

What Has BRICS Already Done Toward De-Dollarization?

Even without a common currency, BRICS is making real moves:

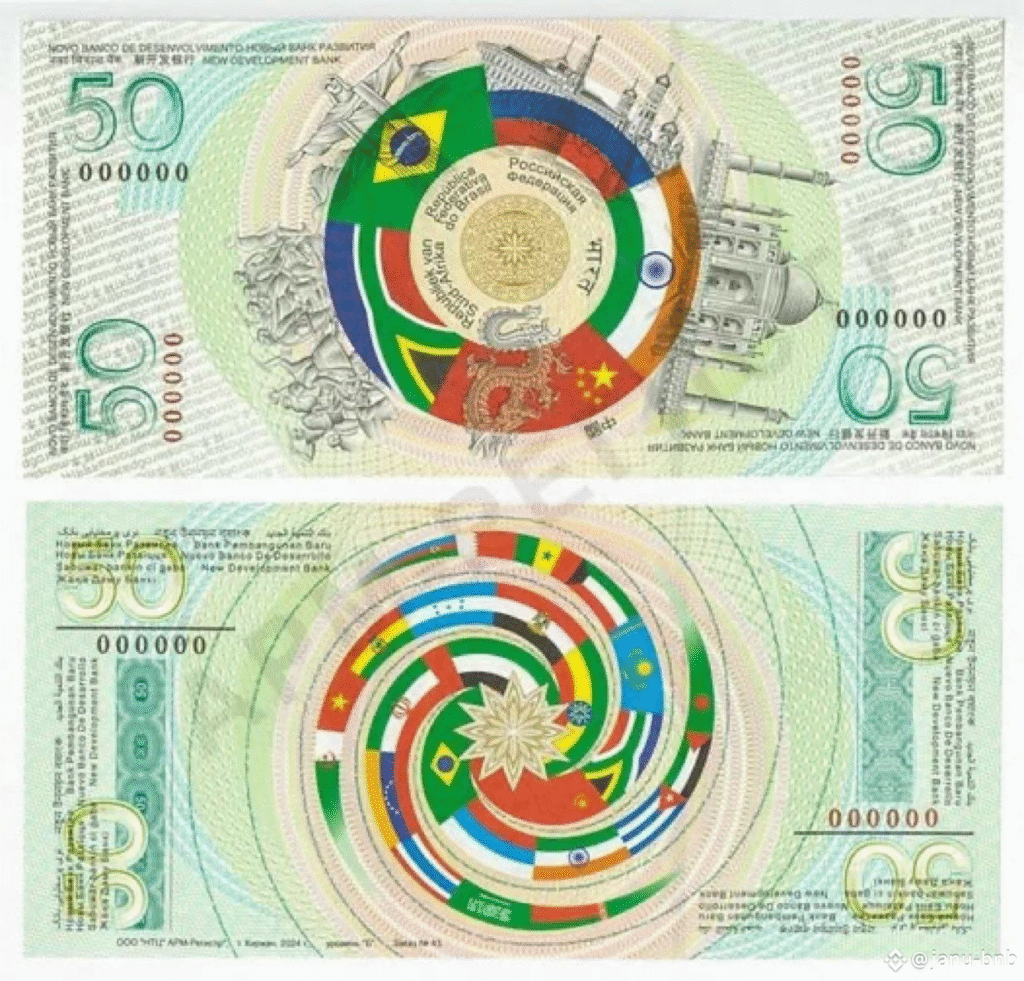

1. BRICS New Development Bank (NDB)

Founded in 2015.

In 2023, the NDB announced plans to issue 30% of loans in local currencies instead of dollars.

2. Bilateral Trade in Local Currencies

India–Russia Oil: A major share now settled in rupees after Western sanctions on Russia.

China–Brazil: Both countries agreed to settle trade in yuan in 2023.

India–UAE: In 2023, India made its first oil payment to the UAE in rupees, marking a milestone.

3. Use of China’s CIPS

China is promoting CIPS (Cross-Border Interbank Payment System) as an alternative to SWIFT.

4. Currency Swap Agreements

India has signed rupee settlement mechanisms with over 20 countries (RBI, 2023).

Case Example: When Russia faced sanctions, Indian refiners like IOC shifted to rupee payments — saving millions in forex costs.

To understand how trade documentation works in such cross-border deals, see our guide on Customs Transit Declaration (CTD).

This is similar to how preferential trade agreements like CEPA make imports cheaper (

This is similar to how preferential trade agreements like CEPA make imports cheaper (